Dear Fellow Investor,

More Americans than ever are worried about running out of money in retirement… and they should be.

According to the Survey of Consumer Finances, nearly half of all U.S. households have no money at all saved for retirement.

Among those already retired, the savings rate is better… but still only $171,000 in 2022.

What’s more, people today are living decades longer than in the past.

Experts say that the average 65-year-old can expect to live at least 20 more years, until 85.

The problem is the estimates keep being revised upward.

Yes, People Really CAN Run Out of Money During Retirement

When today’s 65-year-old was born, the experts predicted he or she would only live to around 68.

Yet we now know that estimate is way, way off — by nearly two decades.

A typical retiree today should have enough income to last well into their 80s and often 90s.

And that’s just the average. A surprising number will live even longer, into their 100s. Aside from government employees, the number of retirees who collect a traditional defined benefit pension has declined a whopping 55% over the past decades, to just 12 million people in 2020.

And with interest rates still far below what they were in the 1970s and ’80s (and most likely moving lower), it’s difficult for many retirees to generate sufficient income once they stop working.

Yet There Is a Simple but Little-Understood Solution to This Looming Retirement Crisis

It’s an advanced income strategy popular with the super-wealthy.

It’s a way for retirement-age couples and individuals to LOCK IN monthly payments with a guaranteed payout yield of up to 11.1% annually for life.

That’s about 761% MORE cash than the average dividend payout of S&P 500 stocks.

And here’s the best part: These payments are NOT affected by anything going on in the stock market or in other financial markets.

The stock market could lose 100% of its value — and this investment would still pay out to those invested in it.

Bonds could get wiped out.

The U.S. government could hit another debt ceiling.

Social Security could begin SLASHING its payments.

And yet investors would still get their monthly payments like clockwork!

There’s only one downside: This rare, once-in-a-generation opportunity to lock in DOUBLE-DIGIT returns for life may not be available much longer.

I’ll tell you more about this in just a moment.

But first, let me explain why it’s so important to take advantage of this opportunity before it’s too late.

A Lifetime of Estate Planning Has Revealed Some of the Best Secrets of the Very Wealthy

My name is Roger Michalski, publisher of Eagle Financial Publications.

We’ve partnered with an elite consulting group known as Generational Wealth Strategies.

They’re a team of experts in wealth and estate planning, health care financing, retirement investing and charitable giving.

Many of their clients are super-wealthy.

Yet our goal and theirs is to create practical, step-by-step plans for ordinary people to enjoy the retirement of their dreams, and to live without having to fear running out of money.

Generational Wealth Strategies does this by sharing with regular folks the elite strategies and little-known investment opportunities of their wealthy clients.

In other words, they specialize in helping people navigate the complexities of creating a prosperous retirement.

And today, retirement is no longer as simple as it once was.

Retirees now face dangers their parents and grandparents often did not, such as the threat of…

… running out of money during retirement…

… or having a catastrophic health problem wipe out savings…

… or facing unexpected lawsuits from Ponzi schemes.

Fortunately, there are powerful protections available against all of these threats — ways once limited to the super-wealthy.

For now, however, I’d like to focus first on one of the biggest threats many people face: making sure they have enough income throughout their entire retirement.

Why the Stock Market Is Often NOT the Answer

Here’s the problem in a nutshell.

The overwhelming majority of retired people, or 85 million Americans, have their savings in defined contribution accounts, such as 401(k)s, SEPs or IRAs.

After a lifetime of contributions to these accounts, eventually the time comes for retired people to begin withdrawing money or otherwise generating an income from their savings.

The problem is, how should this money be best invested so it lasts throughout retirement?

Rich people rarely worry about this.

Studies have shown that most people with $10 million in various retirement accounts at age 65 will likely never run out of money unless they spend like Mike Tyson.

But what if someone has only $1 million… or $500,000?

Well, they face some hard decisions… and potentially big risks.

Why Betting Retirement On the Stock Market Can Backfire

Millions of baby boomers have been told that the best (or even the only) way they can afford to retire is by investing in risky stocks and even riskier bonds.

After all, they’re told, the S&P 500 has averaged 10% per year for the past 30 years — which is true.

That’s a far better return than they can get with any other investment, the “experts” say.

Yet what the “experts” and stockbrokers don’t want them to know is that performance averages for the market over a 20- or 30-year period don’t accurately reflect all the risks involved in stock investing.

What counts for retired people is what’s known as the sequence of returns.

This is a fancy way of saying that it makes a HUGE difference to someone’s finances if the stock market has a few bad years when they first retire compared with when they’ve been retired a decade or more.

In fact, it can mean the difference between having a continuous source of income in retirement and literally running out of money in as little as 10 years.

Let me show you what I mean.

Let’s take a successful couple, Mike and Susan, who retire at age 65 and have $1 million saved in their retirement accounts.

That’s right: a million bucks. Nothing to worry about, right?

Well, you’d be surprised.

Mike and Susan plan to have most of their money invested in stock index funds, like the S&P 500 or SPY, and withdraw only about $60,000 a year from their accounts.

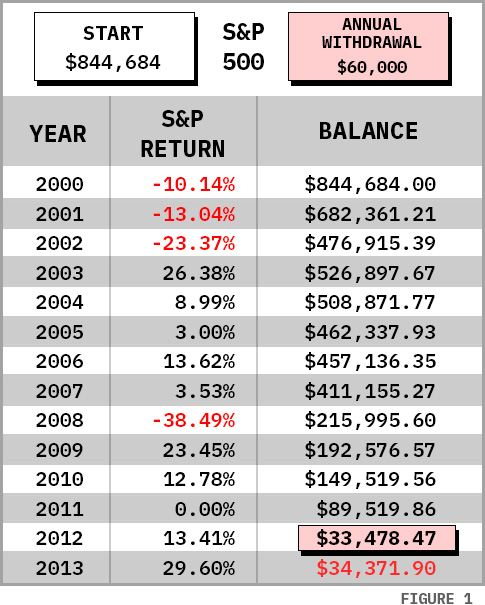

Now, let’s take a look at another hypothetical couple — John and Rosa. Here’s what that will look like using ACTUAL historical returns of the stock market over the past two decades.

Let’s say Mike and Susan decided to retire in the year 2000 when the market had a few bad years.

They started out with $1 million and withdrew only $60,000 per year, yet after 14 years they ran completely out of money.

Sounds incredible, but it’s true. Here’s what that looks like (see Figure 1).

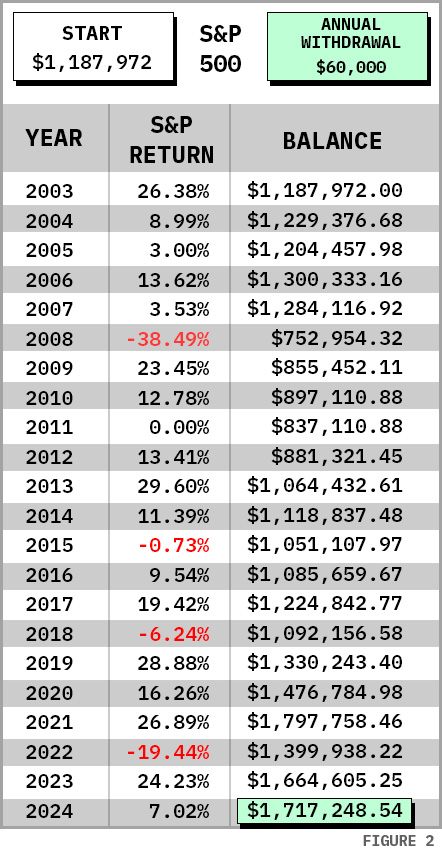

Now, another couple, John and Sally, had the same amount of money and followed the identical investment plan as Mike and Susan. They also put their money into stock market index funds and withdrew only $60,000 per year.

Yet in their case, they not only didn’t run out of money… after 15 years they ended up with MORE money than when they started despite withdrawing $60,000 per year (see Figure 2).

How can these two couples… who had identical financial situations and plans and retired only three years apart from one another… have had such dramatically different results?

The answer is the sequence of returns!

Mike and Sally had the bad luck to have a couple of down years in the stock market when they first retired — down 10% the first year, then down 13%, then down 26%.

Of course, the market then rallied for the next five years, as the stock market often does, but the damage to Mike and Sally’s savings and lifestyle had already been done.

After 14 years, they were flat broke.

Now in their late 70s, their only source of income is Social Security and financial help from their children and friends.

John and Sally, in contrast, had their run of five good years right at the start of their retirement years, and so their account grew large enough so that, when they did eventually see a major market crash — down 38% in 2008 — they were able to weather the storm and then recover quickly.

In other words, the average return of the market doesn’t mean nearly as much as the sequence of returns for most people’s situations.

What About People Who Retire with Far Less in Their Retirement Accounts?

Well, the same financial principle applies… only people in this situation could potentially run out of money much, much sooner, depending on how much they need to withdraw for living expenses.

Pretty scary, isn’t it?

Imagine what it would be like for someone to have to return to work in their late 70s… or watching their wife or husband work at Walmart just to make ends meet.

- Imagine them not having enough money to pay for routine health care.

- Or what if they have to be dependent on their children just for ordinary living expenses?

Yet few financial advisors ever mention the sequence of returns.

They insist that retirees and pre-retirees simply can’t afford not to invest in the stock market.

It doesn’t have to be this way.

GUARANTEED Double-Digit Returns for Life By Not Investing in the Stock Market

For more than a century, the wealthy have used alternative income strategies to generate safe, predictable returns that sustain them during retirement.

These strategies are NOT based on stock market investments.

Instead, they are based on an entirely different type of investments long used by the wealthy.

I’m talking about “Guaranteed Fixed Income Contracts” or GFICs.

GFICs have been around for nearly a century, but many retirees know little about them.

That’s because, unlike a stock mutual fund, they are a bit more involved.

What’s more, stockbrokers downplay GFICs because they don’t make any money with them.

In essence, GFICs are a type of insurance that pays you a guaranteed income of up to 11.1% for life.

The insurance companies are able to pay this much because they pool funds from millions of people, investing the money in rock-solid government securities such as Treasury bonds.

And this allows the companies to pay people who live for 20, 30, or even 40 years longer a far greater rate of return than they can get almost anywhere else.

As I mentioned, right now they pay up to seven times more than the average S&P 500 dividend yield.

In other words: It’s win-win.

Investors get to LOCK IN monthly payments that are guaranteed for life… and the insurance companies profit from investing vast pools of money in low-risk investments.

GFICs Can Work in Almost Any Retirement Situation

“Guaranteed Fixed Income Contracts” come in all sorts of shapes and sizes, for people in different financial situations.

For example, some people invest in a GFIC when they are younger and then wait for three to five years before collecting income, so they can get a higher return on their money.

This is similar to retirees who wait to collect their Social Security payments so they get 20% to 30% more money each month.

Other people invest in a GFIC and begin collecting monthly payments immediately.

Some GFICs are fixed for life… and others for a specific period, from 10 to 20 years.

Other GFICs are used solely to lock in a rate of return, still others to generate income immediately.

For those who want some exposure to the stock market, there are even GFICs that are indexed to a stock market index like the S&P 500 — so if the index rises, a portion of that rise ends up credited to their account.

And if the S&P declines, both the principal and earnings are locked in! For example, if the S&P dips 20% for the year, investors don’t collect any interest… but they don’t lose a dime either.

They get the potential upside of stocks with the safety of a GFIC.

The GFIC that is best for each individual depends on their specific needs.

But there is ONE thing that most GFICs have in common…

They Can Increase Monthly Income WITHOUT Increasing Risk

That’s because the companies that issue GFICs guarantee the rate of return — either for a fixed period of time, such as 10 or 20 years, or even for life.

In other words, you know in advance how much your investment will return to you in income — and you can count on that income no matter what.

And here’s why GFICs are really worth considering right now:

Thanks to rising interest rates, the payments you can lock in are higher than they’ve been in decades!

As I prepare this message, one company is offering a GFIC with an 11.1% annual yield for investors who wait five years before collecting income.

It’s perfect for folks who may have to keep working a few more years but then lock in guaranteed monthly payments for the rest of their lives.

That’s right: The stock market could go down for 10 YEARS in a row… and yet investors would still collect the same amount like clockwork.

It’s a “set it and forget it” type of investment.

The only catch: This rate will likely NOT last much longer.

It could disappear very quickly, as interest rates fall.

What About Heirs?

Many retirees aren’t just interested in income.

They are also concerned with leaving some money to their children, grandchildren or favorite charities.

Well, that’s where GFICs shine.

After all, they are used by the super-wealthy precisely for estate planning purposes.

In other words, by combining different GFICs in an estate plan, retirees can both guarantee a monthly income they can count on… AND… make sure they can leave money behind for those they love.

Because these are investments provided by billion-dollar insurance companies, GFICs are designed for use in estate planning.

A retired couple might use one type of GFIC for income and another type to maximize the value of their estate.

As with income, the death benefit is guaranteed.

That means you know, in advance, precisely how much money your loved ones will collect when you die.

Once again, it doesn’t matter what happens with the stock market — if there is a 2008-style market crash or something similar, this investment will continue to pay off like clockwork.

When you know your income will be consistent in the future, it’s easier to plan accordingly.

How Much Do GFICs Cost — and How Do Investors Know Whether They Are Safe?

Best of all, there are GFICs for just about every budget and situation.

Your investment can be as little as $10,000 or as much as $10 million.

Of course, the more money that’s invested… the more that’s collected in income.

You’ll know the rate of return in advance: You can lock in yields that are as high as 11.1% as I prepare this message… and they are guaranteed.

So, how do people know if the companies that issue GFICs are safe and reliable?

GFICs are issued by insurance companies — a $1 trillion market in the U.S. alone — which are regulated by law and required to maintain cash reserves in case of nationwide financial turmoil.

Deposits made with insurance companies are NOT bank deposits and therefore are not insured by the FDIC.

In a sense, GFICs represent a middle ground between government-backed bank deposits (zero risk up to each $250,000 deposit but with very low returns) and the stock market (maximum risk).

In addition, insurance companies are themselves insured by reinsurance companies, so there is extra protection that way.

Most experts believe that GFICs are safe investments provided investors work with a reputable insurance company that has a high financial rating by one of the rating services.

A Safer Path

The bottom line is that “Guaranteed Fixed Income Contracts” can often provide a safer path to retirement prosperity.

It’s true, someone might end up with more money had they invested in the stock market… but they also might run out of money if the market tumbles when they first retire.

Rather than worrying about how much income you’ll receive each month or year from your stock investments, with GFICs you can know for certain.

By combining different GFIC investments, you lock in a guaranteed income for life… and a guaranteed payout to your heirs when you pass away.

Find Out How to Take Advantage of Near-Record-High GFIC Payments

And the best news of all is that there has rarely been a better time to invest in “Guaranteed Fixed Income Contracts” than right now.

The annual yields are the highest they’ve been in decades.

And the folks at Generational Wealth Strategies have prepared a brand-new, up-to-date report on GFICs that I’d like to send you FREE when you sign up for our offer (details to come).

It’s called “Guaranteed Income: How to Lock In Double-Digit Returns for the Rest of Your Life.”

This is a privately prepared special report that is NOT available on Amazon or anywhere else, at any price.

But you can get a copy right now, on me.

In this report, you’ll discover…

- How to lock in double-digit annual returns for the rest of your life, guaranteed…

- The right way and wrong way to purchase a “Guaranteed Fixed Income Contract”…

- How to make sure heirs get the maximum amount of money possible…

- The role of GFICs in tax and estate planning…

- How to invest with the right GFIC company…

- And lots MORE.

“Guaranteed Income: How to Lock In Double-Digit Returns for the Rest of Your Life” is NOT available in bookstores or on the Internet.

But there is a way you can get a copy right away… and without risking a single dime.

Introducing….

Generational Wealth Strategies A Comprehensive Planning Service for Retirement

Generational Wealth Strategies is an ongoing resource of proven retirement and legacy planning resources.

It’s a newsletter produced each month by four contributing experts who have dedicated their lives to safeguarding people’s wealth from constantly changing dangers…

Consumer Advocate David Phillips

Dave Phillips is the estate planning guru on the team, with 51 years of experience. His various companies have helped thousands of families protect and maximize their wealth for a better retirement and improved, tax-efficient legacy.

Plus, he has decades of experience with all the new financial tools designed to insulate investor assets from unforeseen long-term medical expenses.

Perhaps you have seen Dave on TV as he shares his tips and advice on CNN, Fox News, CNBC, Money Talks, and Bloomberg, or perhaps you’ve read one of his best-selling books.

Financial Threats: Safe Money Expert Todd Phillips

Todd Phillips is a recognized expert in safe money investments. Each month he’ll update you about the changing rules for safe money investing, introducing easy, step-by-step, “paint-by-numbers” tools that almost anyone can use to satisfy their financial needs.

Legal Threats: Attorney Richard Durfee

Richard Durfee will keep you updated each month, helping you sidestep the potential asset and estate threats people might face today. Richard is recognized nationwide as a pioneer of preventive law strategies and has properly shielded thousands of estates nationwide from creditors, predators and the IRS.

Legacy Threats: Melodie Gatz

Every month, Melodie will share her legacy and gifting expertise in solving tax and legal issues, showing regular people how to transform their estate into a virtual fortress of financial security that keeps on giving.

Since the rules of retirement and estate planning constantly change, these renowned experts continuously scan the political, legal and financial landscape, often detecting threats years in advance…

And each month, they keep members up to date with the very latest strategies and solutions.

In other words: They can help significantly reduce the possibility of being blindsided by financial disasters most people didn’t even know existed.

With their help, members are aware of new threats long before they even appear on other people’s horizon… and they have access to the solutions spelled out for them.

With this level of service and advice, you may now wonder…

What Does an Investment in Generational Wealth Strategies Cost?

Normally this collection of VIP estate planning, wealth protection and retirement maximization resources… and spot-on monthly newsletters and updates… could cost thousands of dollars if someone had to pay an attorney or retirement expert to reveal them.

Plus, they’d have to spend hours on the phone, tracking down multiple specialists, checking their reputations and making appointments to get answers…

Add to that even more hours trying to coordinate all the different sales pitches they receive from their brokers, crunching all their numbers, dealing with surly salespeople, and being placed on hold…

And it’s easy to see why so many simply give up…

Fortunately, there’s a much better, much more affordable way…

Save hours of frustration… and all the outrageous fees they charge… simply by agreeing to a 30-day, money-back guarantee preview of our wealth protection advisory, Generational Wealth Strategies.

And That’s Not All: Act TODAY and You Get Three Additional BONUS Resources

One of the biggest threats retirees face is running out of money in retirement.

But that’s not the only threat they face.

Inflation can eat away at their savings.

Even worse, greedy politicians in Washington, DC, and state capitals are eager to plunder their savings as well.

It comes as a shock to many retirees, but taxes don’t go away when you retire.

In fact, they are often even more complex and burdensome.

And depending on the situation, taxes can sometimes take a bigger bite out of someone’s income than they did while that person was working.

That’s because Americans have an estimated $28 trillion tucked away in so-called qualified tax-deferred savings accounts — money the politicians want to force Americans to spend so they can tax more of it.

That’s the reason why they passed “mandatory distribution” laws.

You see, until recently, Americans lived on their retirement savings, and when they finally passed away, their children and grandchildren inherited the money, often distributed slowly over many years.

This way heirs and beneficiaries collected the money when they needed it — and the inheritance funds didn’t push them into higher tax brackets.

But this old system wasn’t fast enough for the politicians! They wanted the money quicker!

As a result, on January 1, 2020, both Republicans and Democrats passed a new law that made it easier to tax IRA money while retirees are still living (through required minimum distributions) AND forced heirs to inherit the money within 10 years.

And that’s just the beginning.

Congress also recently proposed a law giving them a sneaky way to tax people’s “tax-free” Roths.

The Wall Street Journal warns…

“The bill would actually reduce the value of ALL retirement savings plans: individual retirement accounts, 401(k)s, Roth IRAs, the works.”

Now, these government thieves know the money put into a Roth IRA has already been taxed. So they had to devise a sneaky new way to get at it again.

As of this writing, the bill has yet to pass… but this is what many of the politicians in BOTH political parties want to do.

Bonus #1

How to Better Protect Your Savings from Uncle Sam

Fortunately, there are ways to protect most people’s life savings from the schemes greedy politicians dream up — legally and ethically.

One of the experts at Generational Wealth Strategies, David Phillips, has published a new report on how to structure your finances to legally minimize taxes before, during and after retirement.

There are many strategies used by the wealthy to keep the IRS’s hands out of their pockets — and David reveals how regular people can use these secret tips, strategies and techniques to lower their tax bills.

This report is called “Legally Reduce Your Taxes During Retirement.”

Some of the strategies revealed in this report are simple — for example, making sure dividend investments are in tax-deferred accounts rather than in taxable ones.

But others are less obvious.

In your copy of “Legally Reduce Your Taxes During Retirement,” you’ll discover…

- How to create a tax-free, multigenerational financial legacy for those you love…

- One of the best ways to generate tax-free income for life while retired…

- The right way and wrong way to take required minimum distributions to minimize taxes…

- How to convert an IRA into a tax-free cash account — and instantly increase your estate tax protection with zero out-of-pocket expense…

- Simple strategies to pass more of your wealth on to your heirs…

- How to make sure the SECURE Act’s new 10-year rule doesn’t devastate an estate…

- How to legally keep the IRS’s hands off your IRA funds by gifting more to your children and grandchildren…

- And lots MORE!

All inside your first bonus report: “Legally Reduce Your Taxes During Retirement.”

But that’s not all — there is another resource I want you to get as well.

Bonus #2

The Family Bank Strategy for Maximizing Income and Protecting Wealth

You’ve probably heard that the very wealthy do things differently than average folks.

They have the expensive lawyers, accountants and estate planners to generate plenty of tax-free income AND leave piles of money to their children and grandchildren.

But here’s something you may NOT know: These same elite strategies work for almost anyone, in almost any situation!

And they don’t require a lot of money, either. They just require know-how.

Here’s one example: life insurance.

The wealthy use life insurance for lots more than simply the death benefit.

They use it especially to maximize their income, reduce their taxes and make sure most of their money goes where they want it to go.

One name for this strategy, or rather combination of strategies, is the “family bank.”

A family bank is a legal estate planning structure that takes advantage of certain loopholes in the tax code when it comes to life insurance.

You see, unlike IRA funds or proceeds from the sale of real estate, money from life insurance policies is inherited tax-free.

That’s right: If you leave a $2 million IRA to your children, it will not only be included in your estate… but your children who inherit it will have to pay income taxes on the distributions over a minimum of 10 years.

However, if they receive $2 million from a life insurance policy, they don’t have to pay any taxes on it. Not a single dime.

Well, great for them, you might say. But how does that help the retired person while they’re still alive?

And that’s the part the wealthy understand while many ordinary investors do not.

By creating family trusts, the wealthy are able to take money from a family bank life insurance trust and have it converted into a tax-free cash account.

The money grows tax-free.

The income that this account generates is also tax-free.

And retirees can borrow money from the family bank tax-free.

In other words, by combining life insurance planning with estate planning, people can collect income tax-free AND guarantee their heirs also get lump-sum inheritances tax-free as well.

It’s win-win for everyone — EXCEPT, that is, for the IRS.

It’s a 100% legal strategy used by wealthy families across America.

And now you can find out these secrets as well. I’ve prepared a comprehensive guide to family bank retirement strategies called “The Family Bank Strategy Revisited.”

This privately printed dossier may be one of the most important financial planning documents I’ve ever seen when it comes to retirement.

It pulls back the curtain on the elite estate planning strategies of the wealthy.

It also reveals some of the most closely guarded secrets of America’s richest families.

In other words, “The Family Bank Strategy Revisited” reveals several ways the rich get richer.

In it, you’ll discover…

- The three advantages a family bank strategy has over Roth IRA conversions…

- An easy way family banks can loan family members funds for college, career advancement, cars, even business projects…

- A simple way to fund down payments for family members with a family bank strategy…

- The secret to passing on large IRA balances to children and grandchildren via a trust…

- And lots MORE.

I’ll tell you how to get a copy of this bonus report in a moment as well.

Bonus #3

Protect Retirement from the Number One Wealth Buster for Older People

But there is ONE more topic I want to mention.

It’s how to protect against the number one threat to retirement wealth and prosperity: catastrophic health care problems.

For someone who is married and over 65… there’s a 91% likelihood that they or their spouse will experience serious long-term health care costs that could wipe out their retirement nest egg and financial legacy.

In fact, out-of-control health care and long-term care costs could leave people destitute, relying on children or (worse!) the government for the rest of their lives.

For example: The “average” cost for a private room in a nursing home is $297 per day. That’s $108,405 annually. And that’s the average cost at an average facility. Many cost far more.

And not only are prices rising rapidly…

These six-figure annual costs are often NOT paid for by Medicare.

Long-term health care is generally NOT covered by:

- Medical insurance

- Medicare supplement plans

- Group/employer insurance

This is why the American Association for Long-Term Care Insurance informs us…

For seniors on Medicare, the benefits are quite limited.”

Well, that’s not 100% true.

Under certain conditions, Medicare may pay 43% of the bill, but only after all other ways to pay are exhausted.

But you don’t just have to take your chances with these dangers either.

I’ve prepared another essential guide to retirement prosperity that takes into account the rising costs of health care for retired people.

It’s called Leveraged Care Solutions”.

Leveraged care solutions are all about simple but powerful financial planning strategies that allow people to prosper despite a big health care expenditure.

In this bonus report, I reveal the secret insurance strategies and planning techniques few financial advisors know about. For example, you’ll discover…

- How to exploit an IRS secret to slash long-term expenses by a whopping 90%…

- A simple way to multiply every dollar deposited in health care accounts by 300%… 500%… even as much as 1,000%…

- How a spouse or heirs could receive up to 200% of deposited money back…

- And lots MORE.

This third bonus special report can be yours, along with the other two bonus reports I just talked about, free of charge, today.

All you have to do to receive them is to take a 30-day, money-back-guaranteed preview of Generational Wealth Strategies…

Once you agree to that 30-day trial, I will rush you downloadable copies of ALL FOUR of these crucial reports I discussed today — for FREE — simply for agreeing to the test-drive.

Let’s Sum Up Everything You Get

Right off the bat, you get access to all four valuable background reports discussed in this message.

- “Guaranteed Income: How to Lock In Double-Digit Returns for the Rest of Your Life.” This is a comprehensive guide to “Guaranteed Fixed Income Contracts,” the alternative to stocks and bonds that can hand out double-digit returns for life — guaranteed! This essential resource reveals the many different types of GFICs and helps you decide which one is best for you. Plus, it gives you tips for evaluating the companies that offer GFICs to produce the income you need, when you need it.

- “Legally Reduce Your Taxes During Retirement.” No one likes paying taxes, especially during retirement and when living on a fixed income. This privately produced dossier reveals how retired people can maximize their income through a few simple, powerful and 100% legal tax-reduction strategies — including how to use estate planning strategies to create more income while also passing more wealth on to heirs and favorite charities.

- “The Family Bank Strategy Revisited.” This essential guide reveals the ins and outs of using life insurance as part of a comprehensive wealth-building, tax-reduction and income-maximization strategy. The secrets in this powerful report walk you through the various techniques for getting the most out of your 401(k), IRA or Roth accounts, and reveal the strategies that allow investors to sidestep probate and other costly hurdles.

- “Leveraged Care Solutions.” With this simple but powerful resource, you’ll have the resources for knowing how to deal with unexpected health care problems in advance… and how to make sure those resources are already in place to deal with whatever problem comes along.

And that’s only the beginning. That’s because, when you accept a 30-day trial of Generational Wealth Strategies, you also get immediate access to these additional benefits:

- Monthly Issues of the Generational Wealth Strategies Newsletter: One of the only publications in America that researches, tracks and issues warnings about new threats to retirements and estates — for anyone concerned with their wealth. The four experts behind Generational Wealth Strategies can spot threats months… even years… before they become known to the general public.

- In-Depth Information Columns: Every month, you can get comprehensive intel from David Phillips, Rick Durfee, Todd Phillips and Melodie Gatz… plus special guest experts detailing tips, tricks and strategies that many of the ultra-rich knew… but that anyone can use today.

- Call an Expert: Throughout the year, you’ll get chances to get on a conference call with one or more of our four experts and other Generational Wealth Strategies members. You can ask the experts questions (no individual advice though). And even though a consultation with any one of these experts could cost up to $750… you get this call with all four — at no cost — included with your membership.

- VIP Access to Our Private Website: You’ll have an encrypted password granting you access to our members-only website. There you’ll find every monthly issue of Generational Wealth Strategies… and full access to our library of current and past research reports. Read them online… or download any of them or print them out and read them at your convenience.

Some people might think that Generational Wealth Strategies is an expensive service reserved solely for the super-wealthy.

After all, estate planning experts, attorneys and accountants routinely bill as much as $750 per hour… if, that is, you can even get an appointment.

And so, just one hour spent with each of the four experts associated with Generational Wealth Strategies could easily run you $3,000 or more.

But you don’t have to pay anything close to that.

In fact, today, you don’t have to pay the $249 regular annual membership for our Generational Wealth Strategies service.

If you act today, you can become a member for a full year and get everything described above for the low price of only…

$249 $77

That’s right: You can access the very latest income-maximizing, wealth-building and retirement-protection resources (formerly only for the super-wealthy) each month for the low, one-time annual investment of only… $77.

Simply by accepting this preview, you can get started today with retirement and estate protection you KNOW you need…

And which could potentially save your heirs thousands or even MILLIONS of dollars down the road.

So, here’s what to do next:

Just click the button below to be taken to a secure, encrypted page where you can tell us where we should send your free copy of “Guaranteed Income: How to Lock In Double-Digit Returns for the Rest of Your Life” plus your other three free bonus guides…

…. along with your subsequent monthly issues of the Generational Wealth Strategies newsletter and other resources and benefits.

Or, you can take advantage of the special offer for only $77 by calling 1-570-567-1225 now to order.

Our 30-Day Money-Back Guarantee

And in case you have the slightest hesitation, let me give you one of the strongest guarantees available…

You MUST be completely thrilled in every way with Generational Wealth Strategies over the coming 30 days.

Or I will INSIST you accept a fast, full refund of every single penny you’ve paid for your membership.

NO QUESTIONS ASKED.

What could be fairer?

Take this 100% money-back-guaranteed 30-day preview now.

Even if you cancel, your special report “Guaranteed Income: How to Lock In Double-Digit Returns for the Rest of Your Life” and your three bonuses are yours to keep as our gift, simply for giving Generational Wealth Strategies a try.

Just click on the button below RIGHT NOW…